Norway has two types of home ownership. Both are good functioning and well organized and protected by law. But still is it important to know a little bit of about the differences before you buy a home in Norway.

Self-owned house or apartment

Detached houses are always self-owned registered in the Cadastre (Matrikkel in Norwegian).

It is registered with a property number (Gårdsnummer Gnr in Norwegian) and a sub number (bruksnummer Bnr in Norwegian) When the bank lends money for purchase of the house, a mortgage is registered in this number In the Property Register (Kartverket in Norwegian)

If it is an apartment building the property (Gnr and sub number) are divided into self-owned apartments with a section number (S.nr in Norwegian) for each apartment. And the bank registers the mortgage on the section number in the Property Register.

Cooperative – co-owner apartments

The property is owned by a housing cooperative. That means that legally the co-owners or unit holders owns the building and property together. But each of them has exclusive right of use of their apartment. Exactly the same rights as in a self-owned apartment. Except for some restriction regarding rental. You cannot rent out the apartment the first year, and after that it is restricted to three years.

So, if you want to buy a property for rental use you should go for a self-owned apartment.

Besides from this it is more or less the same as self-owned. The bank registers the mortgage on the common Gnr and Bnr for the property and the unit number of the property.

You are equal protected by the law in both forms of ownership.

Both types of property are sold on the free market.

For self-owned property you have to pay a stamp duty of 2,5% of the purchase amount. This does not apply to co-owner apartments.

Shared debt in joint property ownership

When you see an add for an apartment in Norway, especially if it is a co-owner apartment, you may see this:

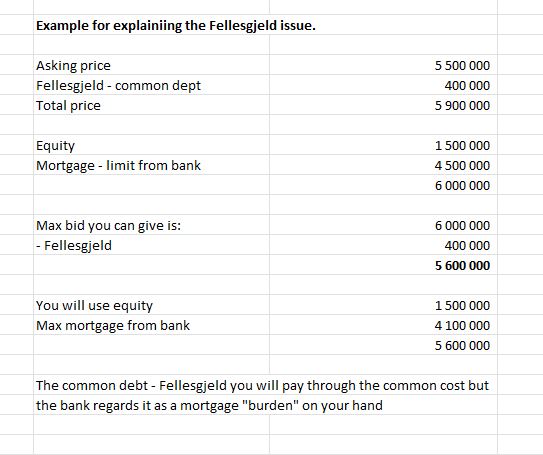

Prisantydning: (Asking price) 5.500.000

Fellesgjeld (Common debt) 400.000

Total pris (Total price) 5.900.000

The bidding round will concentrate on the asking price. You shall not pay the common dept amount. But you will take over this common debt if you buy the apartment and pay it down through the common cost to the housing cooperative.

If you want a mortgage in Norway to purchase the apartment, be aware that the bank will regard the common debt as a “burden” on your hand and deduct if from your maximum mortgage sum.

A bit complicated but important to know.

Let me try to explain with this example:

This is the overall differences between ownership types in Norway. A lot of details are not discussed here. But hopefully you will understand the most important.

And remember, both ownership forms are perfectly safe to buy.

Leave a Reply